Simplify your payroll processes with Workplus Payroll, the most advanced payroll software UAE. Our platform not only automates payroll but also provides powerful analytics and detailed reports, offering valuable insights into your payroll data. Built for the unique needs of UAE businesses, Workplus ensures complete compliance with UAE labor laws, including the Wage Protection System (WPS).

Key Features:

Seamless Integration with Other Systems

Workplus Payroll our HR Software UAE easily integrates with your existing attendance & accounting systems, syncing real-time attendance and timesheets for accurate payroll processing, reducing errors, and improving efficiency.

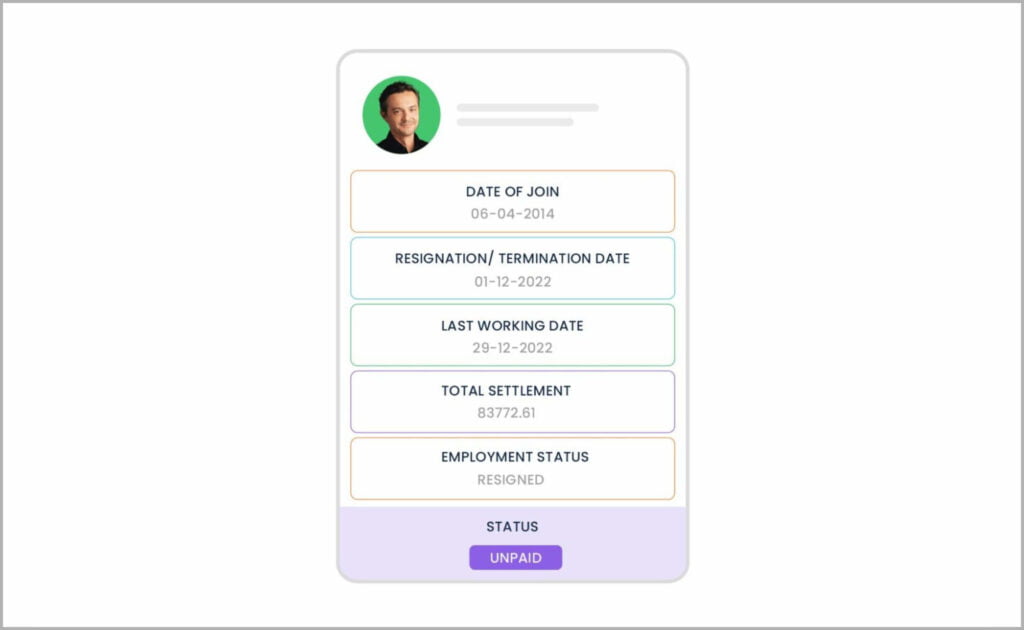

WPS Compliance and Final Settlements for UAE

Ensure full compliance with UAE labor laws through Workplus Payroll Software in UAE. Our system automates the generation of Wage Protection System (WPS) files, ensuring error-free and timely salary transfers. Additionally, Workplus Payroll simplifies the final settlement process, automatically calculating end-of-service benefits, unused leave, and gratuities. Manage employee departures seamlessly, ensuring that all payments are compliant with UAE regulations while maintaining accuracy and transparency.

Say Goodbye to Excel Sheets

No more tedious manual calculations. Workplus Payroll Software UAE automates payroll, eliminating the need for error-prone Excel sheets and saving valuable time and resources.

Tailored Payroll for Every Business

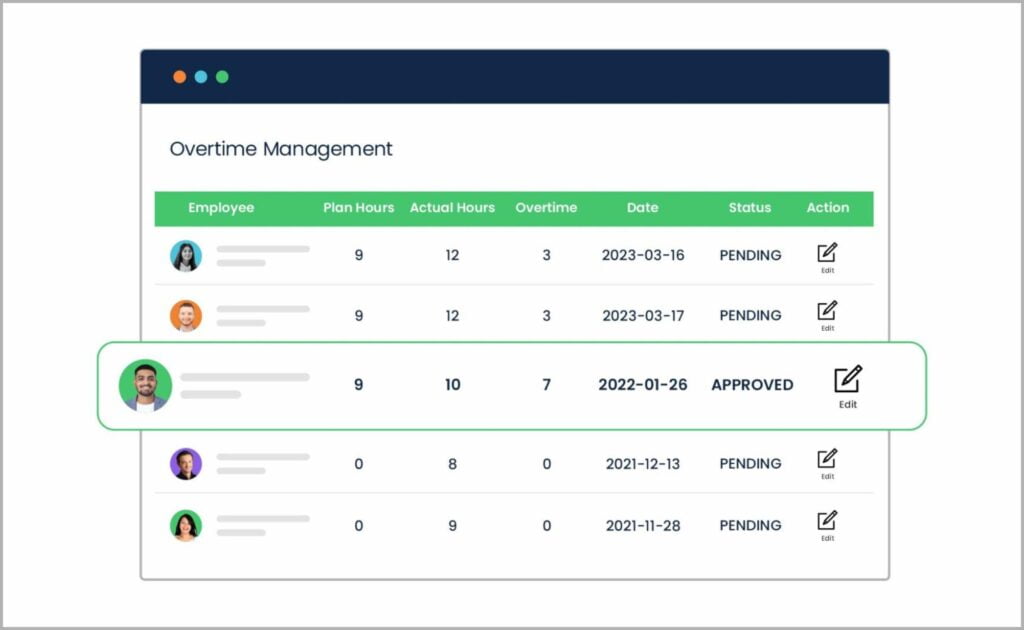

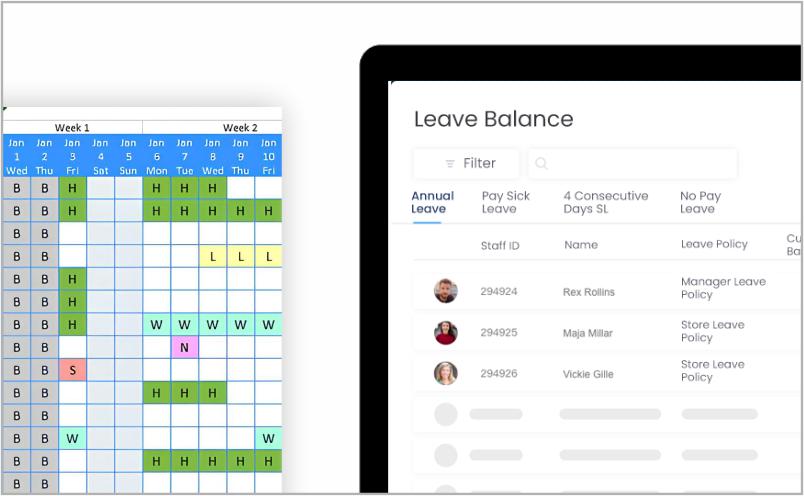

Whether you’re managing employee payroll for a small team or an international workforce, Workplus Payroll Software UAE is fully customizable to your specific needs. From handling multi-currency payments to tracking overtime, leave, and end-of-service benefits, our solution adapts to your requirements, allowing you to focus on what matters most—growing your business.

Complete Payroll Solution for Modern UAE Businesses

With advanced payroll analytics, seamless attendance integration, and multi-country support, Workplus Payroll Software UAE delivers everything you need to streamline payroll operations and stay compliant. Automate manual tasks, improve accuracy, and gain valuable insights into your payroll data with the leading payroll solution designed for businesses in the UAE.

Our Trusted Clients Across UAE and GCC Region